This article aims to list out the key changes made to the Employment Act 1955 the Act through the Employment Amendment Act 2022 the Amendment Act that. In a 6-day working week the Employment Act prescribes that the special rate will.

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

And an hourly rate of pay of RM1875 1508.

. If the employees salary does not exceed RM2000 a month or falls within the First Schedule of Employment Act 1955 then we will refer to the Employment Act 1955. The formula based on 26 days is the minimum hourly rate according to the employment act. MALAYSIA EMPLOYMENT ACT 1955 PART I - PRELIMINARY 1.

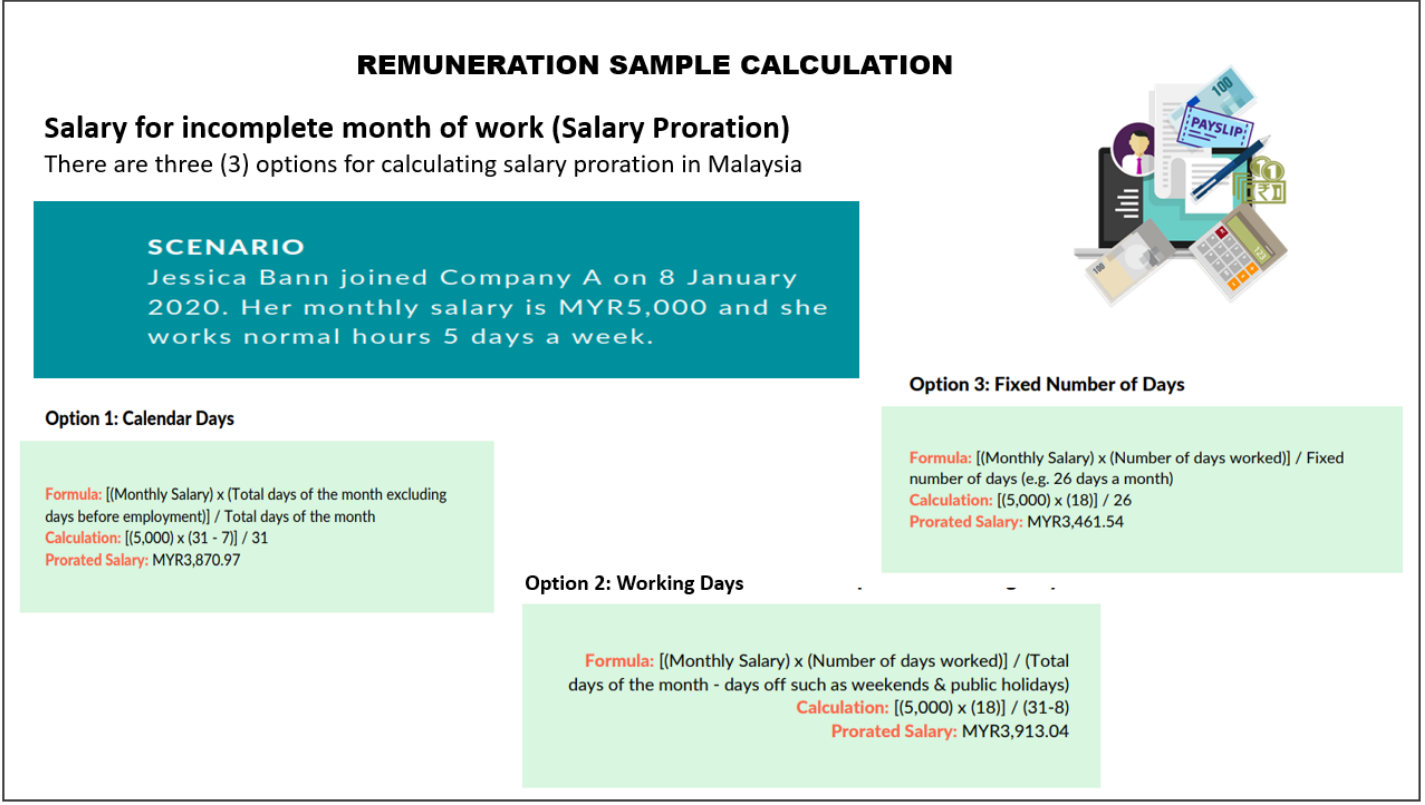

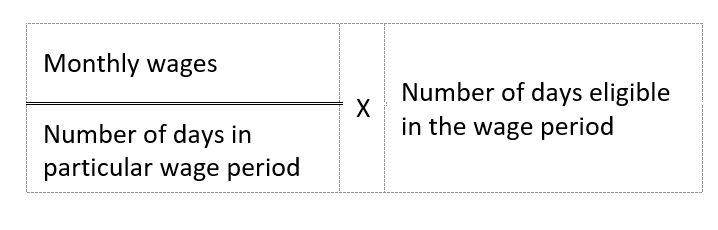

The Employment Act Malaysia 2022 indicates the calculation of wages where employee did not complete a whole month service under these conditions. An employee whose employment relationship has been terminated shall be entitled to be paid at the ordinary rate of pay for the amount of annual leave not taken. The key legislation in Malaysia related to employment matters is the Employment Act 1995 or EA 1995.

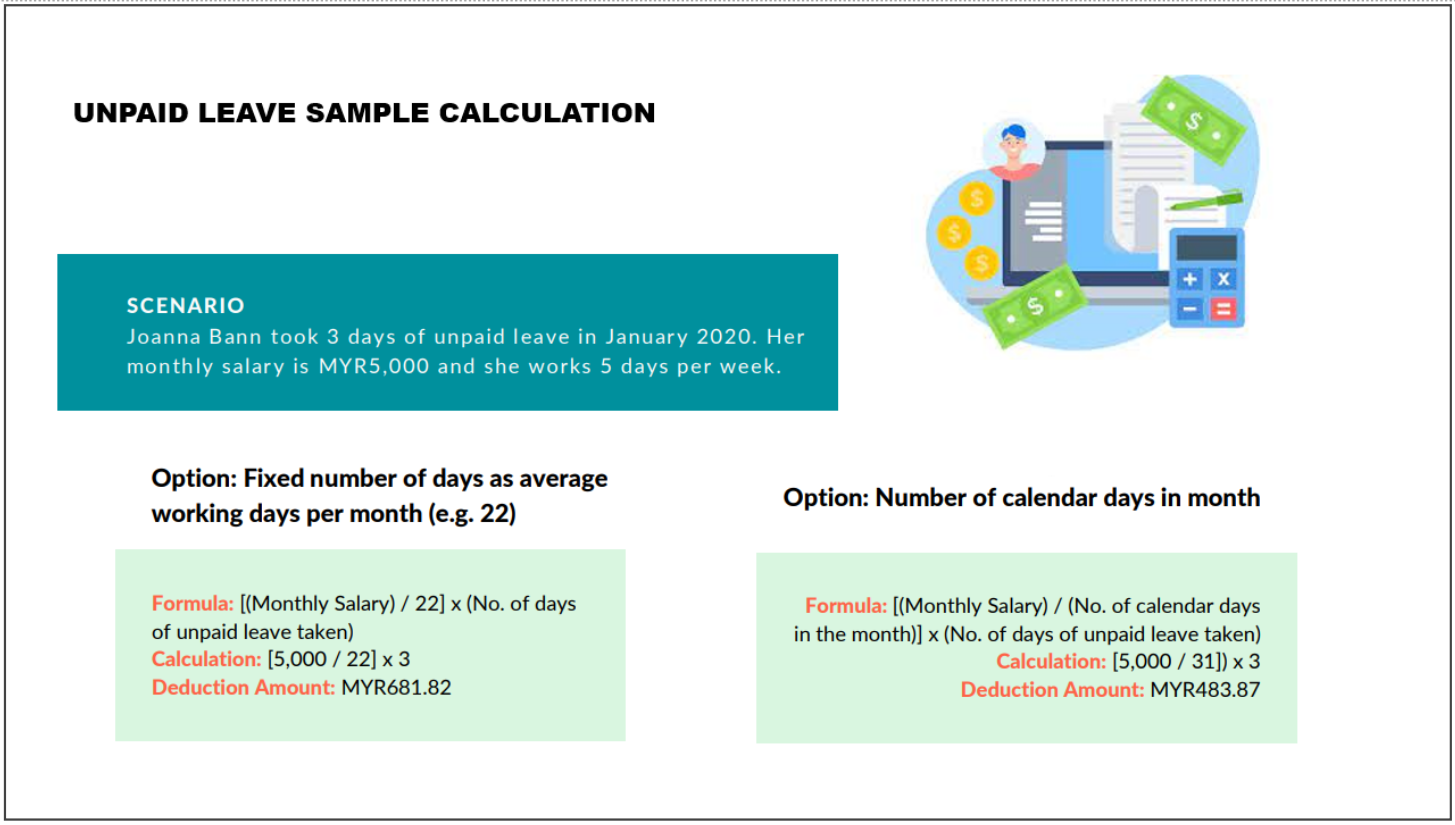

RM2000 3 31. Employee must be paid the average minimum wages as set out by the Minimum Wages Order MWO. January has 31 days example for easy calculation working days are required to subtract PH and Sunday Salary Deduction for incomplete month.

Effective 1 January 2019 the minimum wages for employees in. Malaysia Law On Overtime. Minister may prohibit employment other than under contract of.

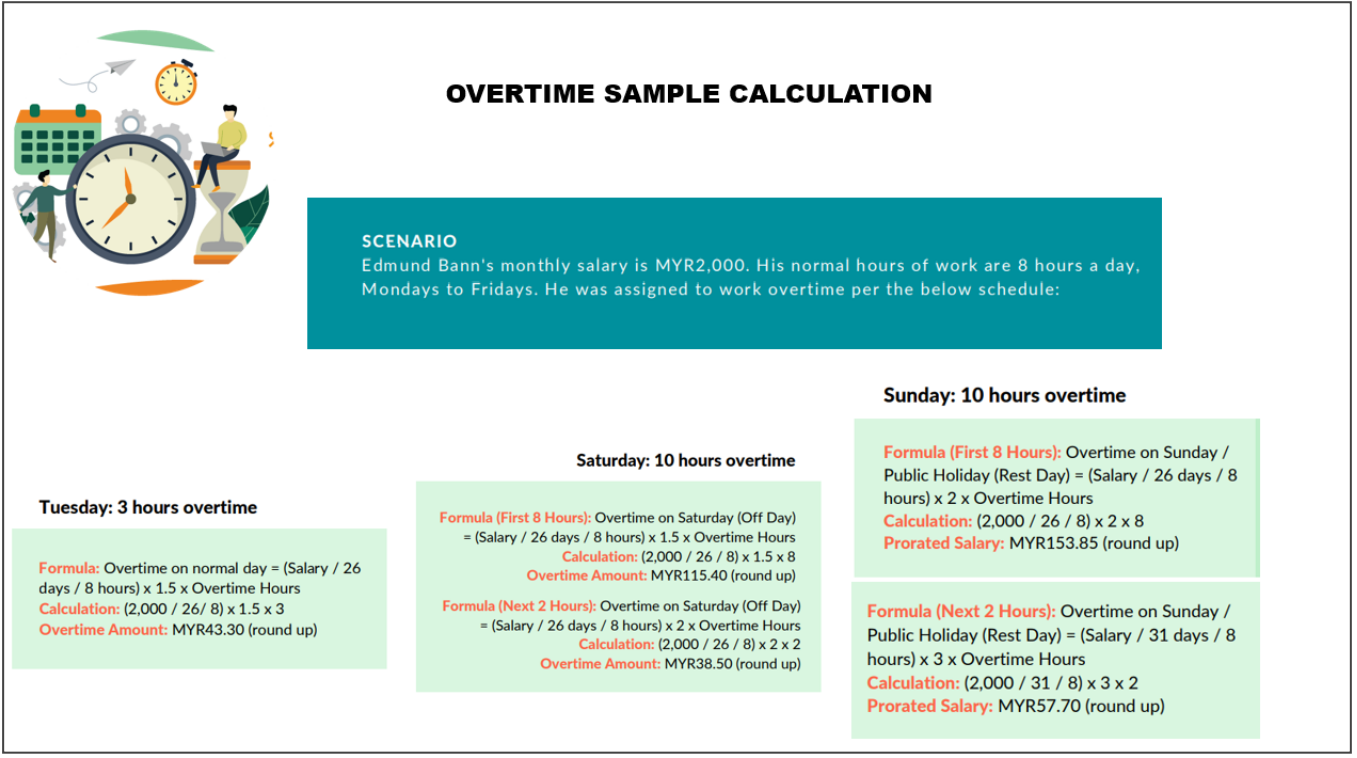

The Employment Act provides that the minimum daily rate of pay for overtime calculations should be. Then calculate the overtime pay rate by multiplying the hourly rate by 15. Below you will find a brief summary of the various labour issues.

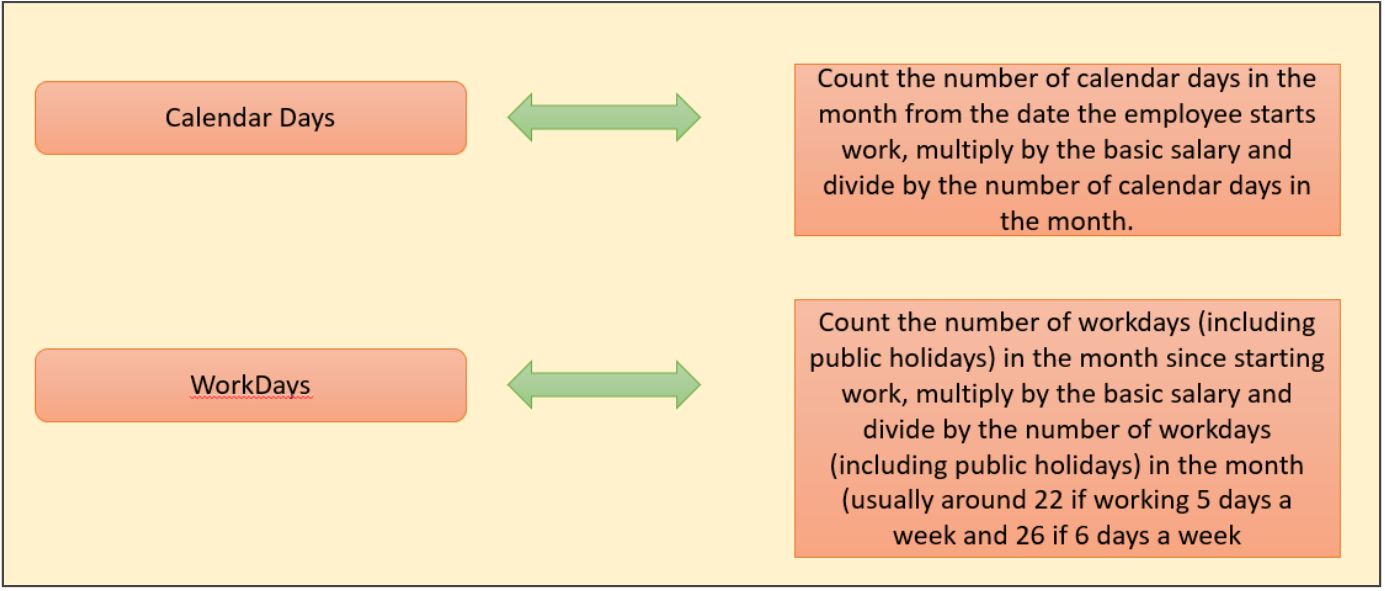

If the employees salary. Divide the employees daily salary by the number of normal working hours per day. Manual calculation of unpaid leave Find the number of working days in the current month.

RM50 8 hours RM625. What employers need to do As a result of these latest EA amendments. Use this number to calculate how much the employee is paid daily monthly salaryworking days in.

The Act applies to employees. Annual Salary Calculator Malaysia Annual Salary is the total amount of salary calculator earned by an employee on an annual basis before any Employee Deduction such as EPF Sosco EIS. To calculate the daily rate you can divide the monthly salary by either of.

RM600 per pax early bird registration extended to 29th August 2018 normal fee RM699 RM500 per pax for group registration early bird rate extended to 29th August 2018 normal fee RM. For any overtime work during the rest day it should be computed as 15 x 2 x ordinary rate of pay. An ordinary rate of pay of RM150 390026.

Annual Salary after deductions is the total amount of salary calculator remaining after the total deductions are made on the employees gross annual salary. C Valid before 1 January 2012 December 2011. However employers are also allowed to choose any other calculation.

The Employment Act 1955 is the most important labour law in Malaysia. Short title and application.

Your Step By Step Correct Guide To Calculating Overtime Pay

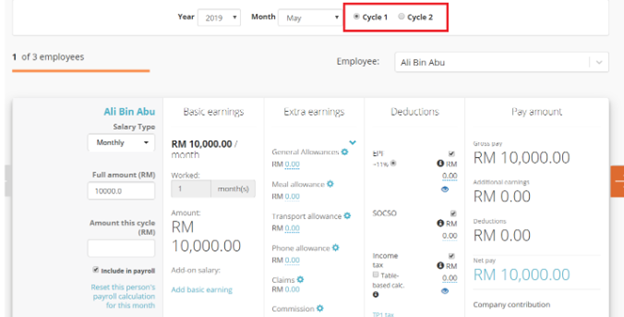

Everything You Need To Know About Running Payroll In Malaysia

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Employment Act 1955 Salary Calculations And Benefits Marm

Employment Act 1955 Salary Calculations And Benefits Marm

Everything You Need To Know About Running Payroll In Malaysia

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Everything You Need To Know About Running Payroll In Malaysia

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Everything You Need To Know About Running Payroll In Malaysia

Salary Formula Calculate Salary Calculator Excel Template

Your Step By Step Correct Guide To Calculating Overtime Pay

Key Amendments To The Employment Act 1955 Rodl Partner

Salary Calculation Dna Hr Capital Sdn Bhd

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube